The indicator Murrey match lines is similar to pivot points and Fibonacci retracement. MML was created based on the observations of Gann studies and is a simple way to implement Gann. It was developed by T. Henning Murrey.

Murrey match lines:

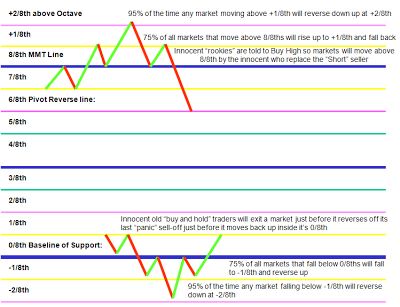

+2/8 – This market is too high and needs close monitoring.

+1/8 – OverBought (Too high on enthusiasm)

8/8 – Hardest line to rise above (overbought)

7/8 – Fast reverse line (weak)

6/8 – Pivot reverse line

5/8 – Upper trading range ——————–

4/8 – Major reversal line

3/8 – Lower trading range ——————–

2/8 – Pivot reverse line

1/8 – Fast reverse line (weak)

0/8 – Hardest line to fall below (oversold)

-1/8 – Oversold (Too Low on enthusiasm)

-2/8 – This market is too Low and needs close monitoring.

Explanation of lines:

Price is between 3/8 and 5/8 MML’s about 40% of the time.

8/8, +1/8, +2/8 th’s and 0/8, -1/8, -2/8 th’s Lines (Ultimate Resistance)

These lines are the hardest to penetrate on the way up, and give the biggest resistance on the way up or support on the way down. (Prices may never make it through these lines).

7/8 th’s Line (Weak, Stall and Reverse)

This line is weak. If prices run up too far too fast, and if they stall at this line they will reverse

down fast. If prices do not stall at this line they will move up to the 8/8 th’s line.

6/8 th’s and 2/8 th’s Lines (Pivot Reverse Line)

These two lines are second only to the 4/8 th’s line in their ability to force prices to reverse. This

is true whether prices are moving up or down.

5/8 th’s Line (Top of Trading Range)

The prices of all entities will spend 40% of the time moving between the 5/8 th’s and 3/8 th’s

lines. If prices move above the 5/8 th’s line and stay above it for 10 – 12 days, the entity is said

to be selling at a premium to what one wants to pay for it and prices will tend to stay above this

line in the “premium area”. If, however, prices fall below the 5/8 th’s line then they will tend to

fall further looking for support at a lower level.

4/8 th’s Line (Major Support/Resistance)

This line provides the greatest amount of support and resistance. This line has the biggest

support when prices are above it and the greatest resistance when prices are below it. This price

level is the best level to sell and buy against.

3/8 th’s Line (Bottom of Trading Range)

If prices are below this line and moving upwards, this line is difficult to penetrate. If prices

penetrate above this line and stay above this line for 10 to 12 days then prices will stay above

this line and spend 40% of the time moving between this line and the 5/8 th’s line.

1/8 th Line (Weak, Stall and Reverse)

This line is weak. If prices run down too far too fast, and if they stall at this line they will reverse

up fast. If prices do not stall at this line they will move down to the 0/8 th’s line.

Alerts: If price moves significantly beyond the +2/8 or -2/8 lines, new octave – the new murrey lines must be set up

Reverse of MML usually will not occur precisely on the line but little above or under it.

If price is above the 5/8 line and falling, it will generally stop and consolidate around 5/8 first before heading lower. The same is true in the opposite direction: if price is below the 3/8 line and rising, it will generally stop and consolidate around the 3/8 line before heading higher.

On top of that, if price is between the 5/8 line and 6/8 line and heading higher, the tendency is to bounce off/reverse off the 6/8 line and retest 5/8 before heading higher. The same is true for shorts, if price is between the 3/8 line and 2/8 line and heading lower, it tends to bounce off the 2/8 line and retest 3/8 before heading lower.

If price moves above 8/8, 75% of the time the price will reverse off the +1/8 line and retest 8/8 before moving higher to +2/8. Similarly, if price falls below 0/8, 75% of the time the price will reverse off the -1/8 line and retest 0/8 before moving lower to -2/8.

Now, if price moves beyond the +1/8 or -1/8 lines, then 95% of the time it will reverse when it hits +2/8 or -2/8. Remember, the market was already in overbought (8/8) or oversold (0/8) mode, so once we push that to the extreme (+2/8 or -2/8) it is extremely unlikely (95% chance) to reverse.

Check out this illustration to see it demonstrated:

Basically, when the market is between the lines, it is in an undecided state (i.e a trading range). If it is above the 5/8 line then the market can be considered bullish, likewise below 3/8 we are in a bearish market. Hence 5/8 is a great support level for re-entering a long trend and 3/8 for short.

A break of these lines can be very important. For example- If the market has been above 5/8 for a period of time but breaks below, that is a sign of bullishness fading. A drop to 4/8 almost always follows, and at that point 5/8 becomes significant resistance, because a break back above it would represent a re-establishing of the bullish scenario which had just previously failed.

If the market does indeed re-test 5/8 and fail, that confirms that the bullish sentiment has pretty much gone and an attempt at a move to 3/8 can be expected. If the market then breaks below 3/8, it has definitively turned bearish – and 3/8 then becomes strong resistance as a break back above would represent another change in sentiment, this time back to indecision.

It’s important use the Murrey on all the timeframes.

Some Murrey match lines strategies:

Buy at -1/8 or -2/8

Sell at +1/8 or +2/8

Buy at 1/8 close at 4/8 or Buy at 0/8 close at 2/8

Sell at 7/8 close at 4/8 or Sell at 8/8 close at 6/8